Disputes in Real Estate Transactions: Legal Strategies That Work

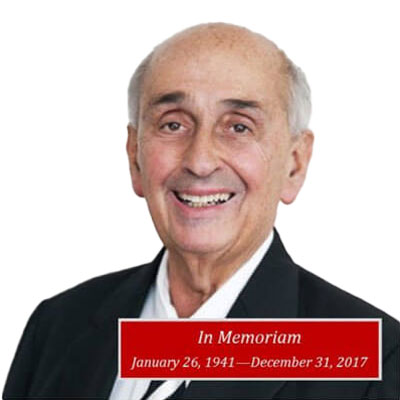

By: Peter S. Sanders – Real Estate Litigation Real estate deals often appear straightforward: purchase agreements, financing, title search, and closing. Yet when disputes emerge, they can derail even the most